Marriage Loan

Multiple days of celebration, with beautiful outfits, grand venues, mouth-watering delicacies, mesmerising decorations, lots of dance, music and masti, and countless other things go into making your Wedding a memorable event!

All of these come at a significant cost, often making you go out of your budget. But, since this is a once in a lifetime event, you can make it memorable without cutting corners with a personal marriage loan from your personal credit line by Freo.

Freo Marriage Loan Features & Benefits

Get approved in real-time for a line of credit of up to ₹ 5 Lakh.

Take ₹ 3,000 or as high as your approved limit depending on what you need to spend on.

Use funds when needed and pay interest on what you use.

An option of swiping the credit card that has a 100% cash withdrawal while you get rewards.

Flexible EMIs between 2 months to 36 months that you can choose from

Required documents include a valid ID proof and an accepted proof of residence.

What are the Typical Indian Wedding Costs?

Destination & Venue

Catering

Wedding Invitations

Accommodation for Guests

Wedding Trousseau & Wedding Outfits

Bridal Jewellery & Accessories

Videography & Photography

Other Ceremonies & Events

Eligibility Criteria

Must be a full-time salaried employee with a minimum take-home salary of ₹30,000/month

or

Must be a self-employed professional with an income of at least ₹30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)

Must be above 23 years and below 55 years of age

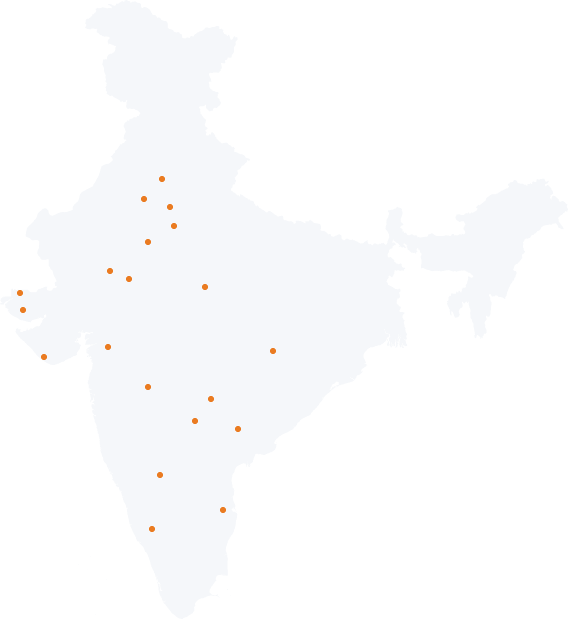

Must be a resident of one of the following cities:

View city list

View More

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

View More

Reasons you are here

Want to have a grand wedding for your child

Want to help your family with the costs associated with the wedding

Looking for additional funding sources for the wedding

Need some extra cash to cover unforeseen wedding expenses

Planning an extravagant honeymoon

Want to send your daughter off with an extravagant trousseau

Want to buy a high-end designer wedding lehenga

Planning a destination wedding

Why Getting a Personal Loan for Your Wedding Makes Sense?

An affordable option as a phone loan that will meet your needs without burning a hole in your pocket.

Higher chance of getting approved for a higher amount.

Lets you save on interest rates and allows you to repay on your own terms.

Choice of withdrawing as per your needs or swiping as a credit card.

Freedom to pay interest on the amount used and not the entire amount approved.

Tips to Use a Wedding Loan Responsibly

Know how much money you need up front so that you don’t end up borrowing more than what you need to avoid paying unnecessary interest.

Make sure you keep your wedding budget reasonable and also try to save money so that paying off your loan becomes quick and easy.

Always make an extra 20% cost estimate for miscellaneous costs. This will keep your finances in order.

While taking a personal loan for marriage, also take into account the expenses required for various ceremonies along with other financial goals such as your honeymoon, buying a new home or shifting to a bigger house.