Instant Personal Loan Online with Freo

Get quick and easy personal loans up to ₹5,00,000 for 2-36 months. Freo offers instant loans through our mobile app with minimum documentation and approval within minutes

What is Freo Personal Loan?

Now you can get an instant Freo Personal Loan of up to ₹5 Lakh without any collateral or guarantors. Use this money for travel plans, mobile phones, medical emergencies, weddings, education loans, home renovation, and more.

Freo Personal Loans start at an interest rate of 1.08% per month (13% per annum). The best part is, you can get an approved credit limit of up to ₹5 Lakh, but you don’t have to pay any interest until you transfer this money to your bank account. What’s better? You don’t even have to transfer the entire amount at once; you can borrow only as much as you need from your limit. The interest will be charged only on the used amount. Repay when it’s convenient for you by choosing flexible EMI options of 2-36 months.

Apply with 3 easy steps

1

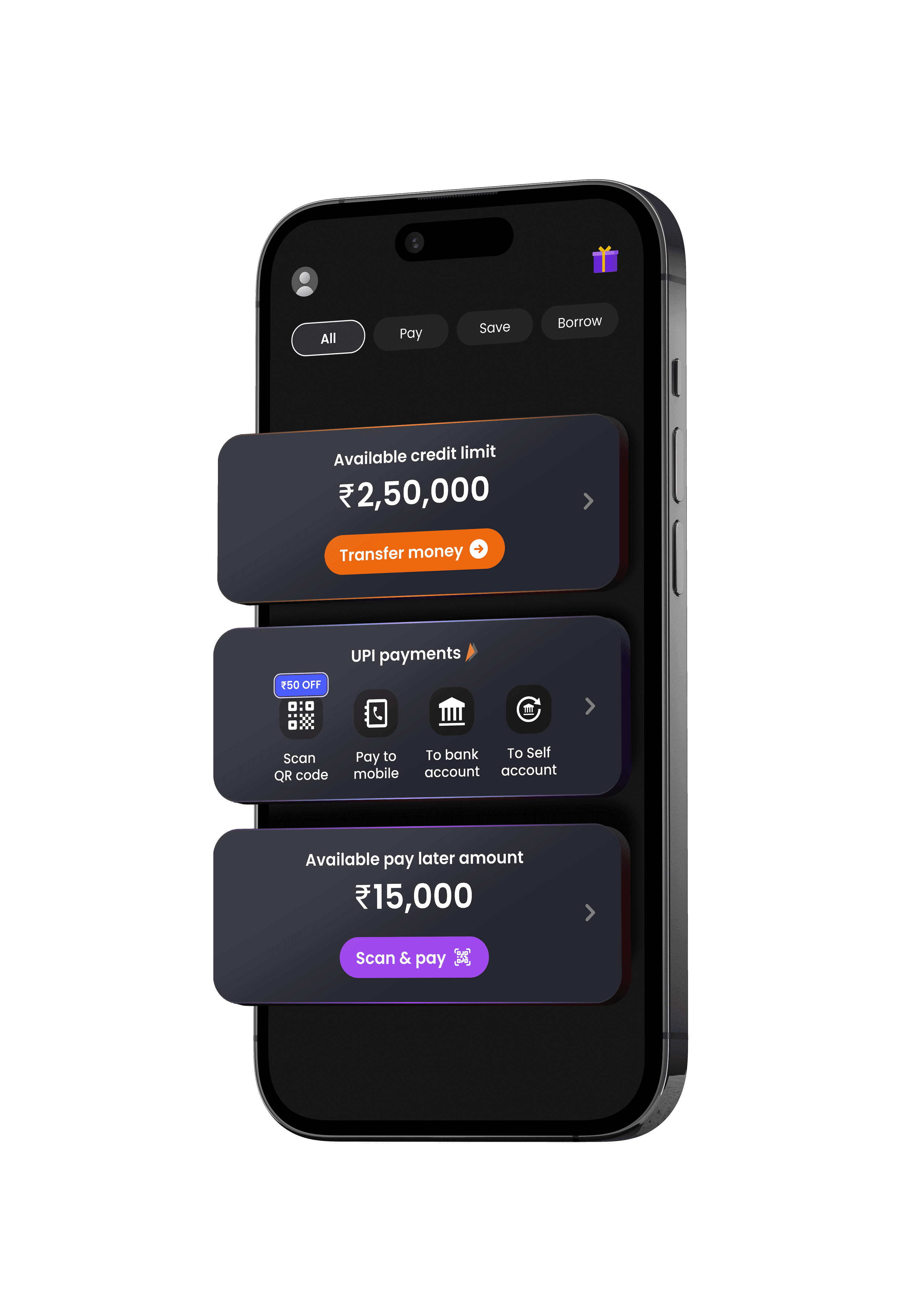

Download the Freo app

2

3

Get approved within minutes

Freo (Formerly MoneyTap) is India’s first and most trusted app-based credit line loan. More than 10 Million people have downloaded the Freo app.

Experience quick, easy, and hassle-free digital loan approval with Freo's new generation Personal Loan 2.0 and get your loan approved within minutes!

Benefits of Using Freo Personal Loan

Instant Approval

Borrow in Parts

Save on interests

Doubles as a Credit Card

Flexible Repayments

All in one App

Eligibility Criteria

Must be a full-time salaried employee with a minimum take-home salary of ₹30,000/month

or

Must be a self-employed professional with an income of at least ₹30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)

Must be above 23 years and below 55 years of age

Must be a resident of one of the following cities:

View city list

View More

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

View More

1.1M

252K

5

10M+

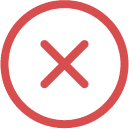

Different Ways to Use Freo Personal Loan 2.0

Marriage Loan

Medical Loan

Education Loan

Two-Wheeler Loan

Mobile Loan

Consumer Durable Loan

Laptop Loan

Used Two-Wheeler Loan

How to apply for Personal Loan 2.0