Looking for Instant Personal Loans in Mumbai?

We have some good news for you!

Mumbai, the city of dreams, is also the primary financial centre of India. Being the most populous city of the country, and property rates touching sky high, it is difficult for most people to maintain a lifestyle and take care of their emergency needs. A good number of Mumbaikars, therefore seek personal loans to make lifestyle upgrades, cover emergency expenses or spend on tasteful experiences. Freo, India’s first app-based personal credit line is apt for the people of this city, whose lives are as busy as the Mumbai roads. Right from its application to its disbursal, everything on Freo happens with just a tap of a button. Downloaded by more than 10 million people, Freo is a fast, secure, and easy way to get access to funds in Mumbai.

Here’s why Freo’s unsecured loan with a line of credit is way cooler than other quick loans in Mumbai:

Faster than the Mumbai Locals

A few minutes of registration on the app is all it takes to get a credit line pre-approved. The process is even quicker if you opt for e-verification.

Zero Interest on Zero Usage

You can now stop worrying about crazy interest rates that are offered by private lenders. You can keep your credit line handy without paying any interest on the unused amount. You pay interest, only when you withdraw. The rest of the time, you have peace of mind, at your fingertips.

2 Products for the Price of 1

Freo gives you credit like a personal loan and also in the form of a credit card. At no extra cost. Now, who doesn’t love a good deal?

Zero Risk

Your personal and bank details are absolutely safe within the app. With all the regulations complied with, everything has been tested for security by our partner banks as well.

No Re-Application

You can keep Freo’s line of credit for as long as you like. So even when you repay what you borrowed, your credit line is always around — ready to be tapped into upon approval.

About Freo

Freo is an app-based credit line offering quick loans in Mumbai. It combines the features of both a quick personal loan and a credit card and adds to it a flexibility which never existed before.

For the first time in Mumbai, you can experience a hassle-free way of getting quick cash loans right when you need financial help. With features like e-Sign, zero usage-zero interest and easy EMI conversions, you will not need to search for another instant loan in Mumbai once you have Freo on your phone.

or

(Only certain professionals like doctors, lawyers, or business owners qualify)

View city list

View More

To be taken on the Freo App

Valid Driving License / Valid Passport / Aadhar Card

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

View More

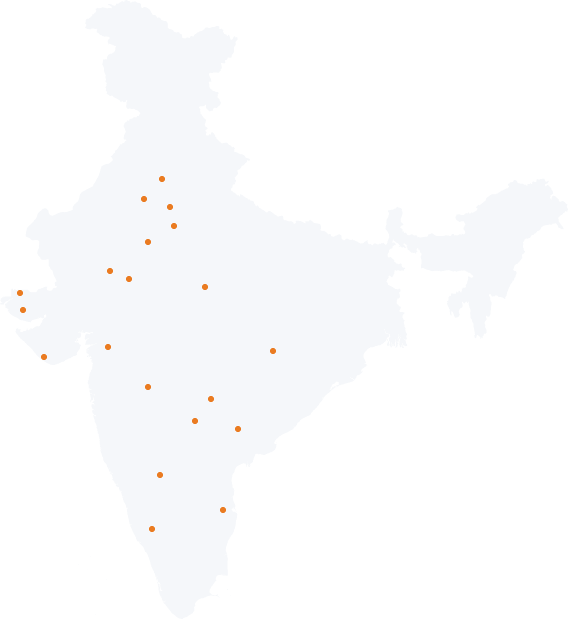

Our journey so far

5 years and counting as India’s 1st app based Credit Line