Laptop Loan

Laptops are now a necessity and owning a laptop that meets all your needs in terms of features, configuration and settings, has become essential. But, buying a laptop that meets all your requirements can often come with a hefty price tag.

With Freo, you can use your credit limit as a personal loan and buy a laptop on EMI without a credit card to meet your needs hassle-free!

Freo’s Features and Benefits

Get instant approval for your line of credit of up to ₹ 5 Lakh.

Withdraw only as much as you need – it could be as little as ₹ 3,000 or as high as your approved limit.

Pay interest only on the amount you use.

Use Freo's credit card to withdraw 100% cash and get rewards every time you use your card to shop.

Repay your spends in flexible EMIs while choosing a convenient payment period - 2 to 36 months!

The only documents you need are your identity proof and address proof to start with.

Eligibility Criteria

Must be a full-time salaried employee with a minimum take-home salary of ₹30,000/month

or

Must be a self-employed professional with an income of at least ₹30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)

Must be above 23 years and below 55 years of age

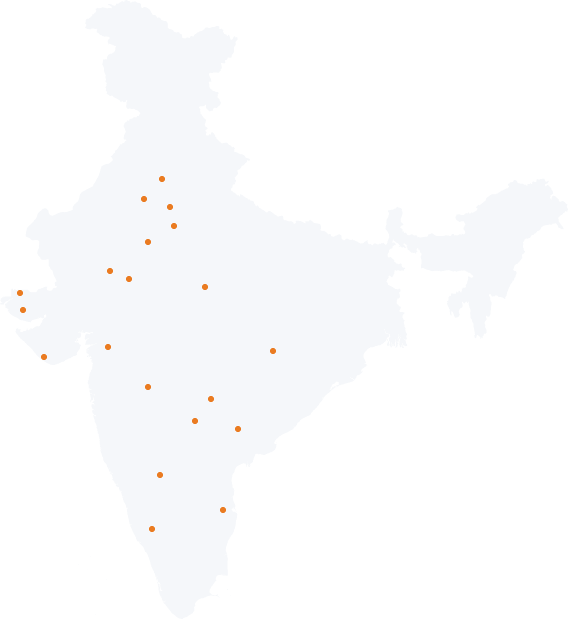

Must be a resident of one of the following cities:

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

Reasons You Are Here

Need to update your old laptop

Want a laptop you can’t afford

Your work requires a high-end laptop

Don’t have enough liquid cash to buy your laptop

Need to instantly replace your old laptop

Laptop malfunctioned when out of warranty

Why Purchase Your Laptop with a Personal Loan?

Using a personal loan to purchase your laptop gives you the freedom to buy the laptop you want without having to wait till you save up.

Laptops are a big-ticket item and also require a significant investment which can impact your financial liquidity. This is where a personal loan for buying a laptop can help.

There are a variety of brands and configurations to choose from, use a personal loan so you don’t miss out on the right combination due to lack of necessary funds.

Using a personal loan to purchase a laptop allows you to stay within your monthly budget by paying premiums/EMIs rather than a lump sum.

Financing Tips When Purchasing Laptop

Do your research and check both online and offline electronic outlets to narrow down on the best deal.

Set a budget for yourself and plan it as per your regular income so you can easily meet your EMI payments.

Remember that technology is rapidly evolving, so be sure to invest in new age technology as opposed to buying an older model simply because of the price difference.

You also need to determine what kind of laptop you're getting and when you plan to upgrade it as that will require you to plan your finances accordingly.