Personal Loan for Salaried Employees

Plan your expenses and investments without letting an unexpected situation derail your financial strategy. Let Freo (Formally MoneyTap) personal loan for salaried employees take care of the expenses that you didn’t plan for.

Financial stability is often a major challenge faced by salaried individuals. If an unplanned expense arises, the financial discipline that they maintain goes haywire. Living paycheck to paycheck is not that rare for a lot of people and there are times when you might need additional financial help or backing when those monthly payments creep up around the 25th or so of each month.

Why Choose Freo’s Personal Loan for Salaried People?

Most people will have some sort of payments that cycle again and again like credit card payments, EMIs, car payments, home instalments, investments, etc., and when it is time to make these payments, there’s a good chance that you’re low of cash. This is when Freo Personal Loan can be a blessing.

Although salary credit happens on a fixed day of the month, unexpected expenses come uninvited. Certain expenses like a medical emergency or your child’s admission fees cannot be delayed. Bill payments like your phone bill, electricity bill, DTH recharge usually have their payment dates at the end of the month, the time of the month when you are left with little or no cash in your account. In such situations, you cannot wait for the salary credit to bail you out. A simple cash loan from Freo personal line of credit can help.

Additionally, there are some other unplanned expenditures that could also spring up like, urgent travel, a close relative’s wedding, medical emergencies, child’s educational needs, etc. To meet these unplanned expenditures, Freo provides unsecured personal loans for salaried people, thus giving you access to a personal line of credit, which you can use as and when required.

Here Are Some Features of Freo That Are Beneficial For Salaried People

Super Fast

You can get your personal loan approved without any collateral or guarantee.

Zero Usage, Zero Interest

This feature makes it one of the most affordable loans in Vadodara. Unlike other loans where you have to pay interest on the entire limit from day 1, with Freo you only pay for the amount you withdraw, whenever you withdraw it. If you don’t use it, you don’t pay any interest rate on it.

Twice as Good

Is it an instant cash loan? Is it a credit card? Well, it’s both! Freo allows you to use the line of credit the way you want, at no extra cost.

No Vulnerability

You can rest assured that your personal data and money is safe with Freo. We use the best encryption systems available to ensure that none of your information is vulnerable at any stage. Freo is offered in partnership with leading banks in India.

‘Immortal’ Loan

Eligibility Criteria

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

or

Must be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)

Must be above 23 years and below 55 years of age

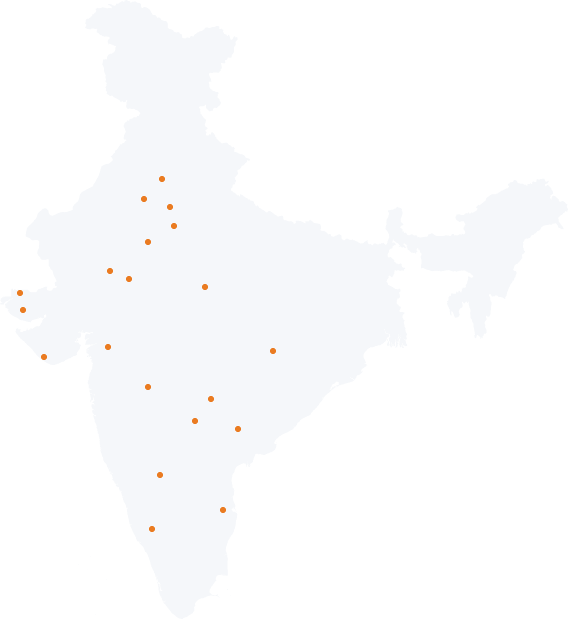

Must be a resident of one of the following cities:

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

How to Apply for Personal Loan 2.0

Advantages of Getting a Personal Loan for Salaried People

Salaried people have a fixed inflow of income at a regular period. This implies that they plan their finances well in advance and try to stick to it. However, when in need of emergency funds, they are at a loss because they do not have other sources of income. freo personal loan for salaried people is aimed at bridging this gap. Here’s how:

A Personal Loan Lets Your Long-Term Investments Stay Undisturbed

As a salaried individual, it is quite normal to keep aside some of the money to invest in SIPs, mutual funds, etc., which is, in fact, a good financial decision for salaried people as mutual funds are known to deliver good returns when held for a long term. But, when a short-term money need arises, is it wise to break your investment or apply for a personal loan? This is where freo can help. Better is to go for a personal loan and let your investments grow.

A Personal Loan Helps You to Keep Your Emergency Corpus Intact

It is always better to hold some amount of liquid cash for a rainy day like a job loss situation. For short-term financial crunch, you can use a part of this corpus, but if your requirement is larger it is recommended that you go for a personal loan rather than use all your corpus. With freo line of credit of up to ₹ 5 Lakh, you can take a personal loan for salaried people without having to disturb your cash balance.

A Personal Loan for Salaried People Ensures Hassle-Free Online Application

freo is a tech-enabled consumer lending platform, where you just have to fill in an application form, upload a few documents and get your personal loan approved. It is a hassle-free process with wide credit eligibility criteria. Salaried people with take-home monthly income as low as ₹ 30,000 can apply.

Someone like you is happy with Freo