Personal Loans for Low Salary: Quick Personal Loan for Low Income Groups

Are you finding it difficult getting a personal loan because of your low salary? You can now enjoy the benefits of a personal loan with Freo’s personal line of credit.

Getting a loan or a credit card is easier for high salaried individuals as their repayment capacity is good because of their high income. Banks and financial institutions usually target high-income groups with attractive offers of an instant cash loan or a credit card. The banks determine the ability of an individual to repay the loan amount by doing this simple math:

If the salary of an individual is ₹ 25,000 a month, 55% of the income can be spent on repaying the monthly instalments, the rest can be used for monthly expenses.

But what about people belonging to the low-income group? Can they get a personal loan with a low salary if they need funds for marriage, education or in case of an emergency such as hospitalization? Yes. Personal loans with a low salary can be granted. Freo offers personal loans to salaried employees with a take-home salary of less than ₹ 15,000, provided they meet the eligibility criteria apart from the salary, which includes age, credit score, company worked for, work city, and years spent staying at the current address.

Why Freo?

Super Fast

Would you believe if we say that the pre-approval is almost instantaneous? Well, it’s true. All you need to do is download the app and register. You will get instant pre-approval on the app without having to wait or call anyone.

Zero Usage, Zero Interest

This feature makes it one of the most affordable loans in Vadodara. Unlike other loans where you have to pay interest on the entire limit from day 1, with Freo you only pay for the amount you withdraw, whenever you withdraw it. If you don’t use it, you don’t pay any interest rate on it.

Twice as Good

Is it an instant cash loan? Is it a credit card? Well, it’s both! Freo allows you to use the line of credit the way you want, at no extra cost.

No Vulnerability

You can rest assured that your personal data and money is safe with Freo. We use the best encryption systems available to ensure that none of your information is vulnerable at any stage. Freo is offered in partnership with leading banks in India.

‘Immortal’ Loan

This basically means that once the line of credit is approved, you don't need to re-apply the next time you want a quick cash loan in Vadodara. You can keep the credit line for as long as you wish, even after repayment. At no extra cost.

Let’s understand how Freo works for low-income earners through Arjun’s story

Arjun works as a Customer Service Executive at a company in Indore. His monthly salary is ₹ 16,000. The amount is enough for him to take care of his parents and look after the monthly expenses. Each month, he is able to save a few thousand, which he puts in a saving account. He has plans to get married this year. However, he doesn’t have enough money to fund his marriage. He falls short of ₹ 50,000. So, he decides to apply for a personal loan with Freo. Here’s how Freo helps him realise his marriage plans:

Arjun applies through Freo app for a personal loan, which is instantly approved after the eligibility criteria were met.

He is given a flexible repayment option considering his financial circumstances.

He can borrow as little as ₹ 3,000 and as high as his approved personal credit line.

Even though his approved loan amount is ₹ 1 Lakh, he withdraws only the amount he needs, that is ₹ 50,000.

Freo’s revolving credit line concept allows Arjun to pay interest on only the amount he withdrew (₹ 50,000) and not on the loan amount that is approved (₹ 1 Lakh).

Eligibility Criteria

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

or

Must be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)

Must be above 23 years and below 55 years of age

Must be a resident of one of the following cities:

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

How to apply for Personal Loan

Here are the benefits of using Freo

The personal loan is accessible to people of high and low-income groups. People with a low monthly income can make use of Freo for their urgent need for funds.

Freo offers flexible repayment option so that people with low salaries can plan their personal expenses and loan amount repayment properly.

The low-income loans appeal to youngsters, who have just started their careers because they can fulfil their small luxuries like buying a gadget or use the fund during emergencies.

Someone like you is happy with Freo

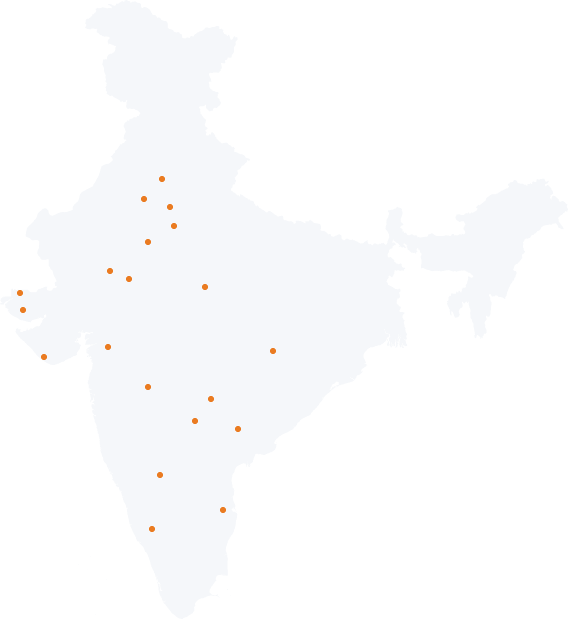

Freo's Personal Loan is

Now Available Across India

Freo Personal Loan for Low Salary FAQs

Can I get a personal loan without a salary slip?

Yes, you can get a personal loan without a salary slip. Having said that, salary slips are one of the important documents that serve as income proof.

So, if you don’t have a salary slip, you can provide the income proof through other sources of documents, such as a salary certificate or your bank account statement.

Along with your income documents, other factors like the company where you work, your employment stability and your credit score decide your personal loan eligibility.

Can I get a personal loan if my salary is less than ₹ 15,000?

Yes, it’s not easy but it’s possible. The personal loan eligibility criterion for income varies from bank to bank. Although a salary of ₹ 15,000 is a bit on the lower side, some banks may not base their loan approval decision solely on income. Other factors like CIBIL/credit score, sources of income (other than your salary), your profession, the company where you are employed, etc. also play an important role in getting a personal loan in India.

Can I get a personal loan on the first month’s salary?

No. Getting a personal loan on the basis of your first month salary is not possible. Most banks ask for 3 to 6 months of bank statements to check your income details such as your salary. If this is your first job and your first salary, you may not be eligible for a loan. However, if it’s your first salary in a new company, you may be eligible as they are other factors that come into play to assess your personal loan eligibility. Some of the loan eligibility criteria are as follows:

Age Criteria: Most banks have an age criterion for salaried individuals, which is 21 to 60 years aged.

Employment Stability: You need to have a work experience of more than 2 years. Banks also look at your annual compensation and the company you are employed with. Being employed by a reputed and high turnover company is an advantage as it indicates that the employee’s job is stable and career s promising.

Credit Rating: Your individual credit rating is an important factor; lenders look at it while considering your loan application. A high credit score increases your chances of getting a personal loan with best loan terms such as flexible repayment options and low-interest rate.

What’s the maximum personal loan amount I’ll get if I'm earning ₹ 30,000 monthly?

With an income of ₹ 30,000, you may meet the income criteria of most banks for a personal loan. But the question of how much you can get really depends on several other factors. Below are some of the factors, banks consider while considering your personal loan application:

Age: Usually 21 to 60 years for salaried and 25 to 65 years for self-employed.

Employment status: Salaried individuals need to be employed for more than 2 years and self-employed individuals need to have a minimum of 5 years of total tenure of earnings.

Current debt: Current debt should not be more than 40% of your monthly take-home salary.

Credit history: CIBIL or a Credit Score should be above 750.

Employer: Being employed with a reputed company is an indication that the employee’s job is stable, and the career is promising.

What is the minimum salary to get a personal loan?

There isn’t one set minimum salary requirement to take out a personal loan. It varies from lender to lender and most banks have anything between ₹15,000-₹25,000 as their minimum salary requirement.

What is a good online personal loan lender for low salary earners?

There are quite a few online personal loan lenders or platforms for the low salary group. A good online loan lender or lending platform would be the one offering these and more:

low-interest rate

long tenure

fast approvals

immediate funding

flexible repayment options

no prepayment charges

Can a low salaried person get an education loan for his/her child?

Yes. A low salaried person can get an education loan for his/her child. However, he/she may have to provide collateral or guarantor to support the education loan.

You can also apply for a personal loan for education. Ensure that you check your personal loan eligibility before applying for the loan. If possible, add a co-signor with a good income and a good credit score to make your loan application strong.

How can I get a personal loan with a low income and bad credit?

There is no collateral involved in a personal loan. Therefore, the risk of lending is very high.

If you have a low income and bad credit history or a low credit score, getting a collateral-free loan is very difficult. But, if you have to get the unsecured loan, you may ask your parents, siblings or spouse with good income and a good credit score to be a co-signor on the loan, so your chances of getting a loan approval increases.