Used Car & Vehicle Loan

Are you thinking of buying your first car, but facing budget constraints? Or, are you looking to buy a second vehicle for your family’s needs? In either case, a used or pre-owned vehicle could be your best bet.

Freo credit to use as your used car loan can be your saviour in these situations and get you closer to your car purchase easily. The entire process is done quickly and in a very transparent manner at Freo.

Freo Features and Benefits

Instant approval of a credit line of up to ₹ 5 Lakh in real-time.

Withdraws can be up to your approved limit or even as small as ₹ 3,000.

Interest is charged as and when you use the funds.

Enjoy 100% cash withdrawal with the credit card and get rewards.

Repay your spends in flexible EMIs of 2-36 months.

As far as documentation is concerned, all you need is an ID proof and an address proof.

Eligibility Criteria

Must be a full-time salaried employee with a minimum take-home salary of ₹30,000/month

or

Must be a self-employed professional with an income of at least ₹30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)

Must be above 23 years and below 55 years of age

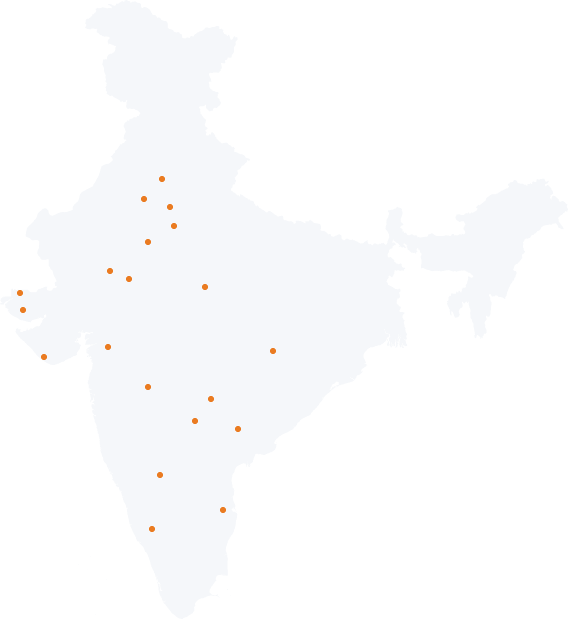

Must be a resident of one of the following cities:

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

Reasons You’re Here

Looking for pre-owned car loans

Need a simpler process to finance your purchase

Confused between taking a personal loan vs an auto loan

Need better used car loan interest rates

Need better loan repayment plans

Need to make an immediate down payment

Approved pre-owned car loan limit is lower than expected

The monthly EMIs on vehicle loans are too high

Why Buying a Used Car or Vehicle on Personal Loan Makes Sense?

Buying a used vehicle on a personal loan allows for more leeway when it comes to the final loan amount.

A personal loan amount is not dependent on the valuation of the used vehicle or car you plan to purchase, so you can finance the entire amount through it.

The loan approval process for personal loans takes lesser time than one for used car loans.

Your auto loan amount is highly influenced by your credit score.

You don’t have to jump through hoops to get pre-owned car loans as per your preference.

Auto loans for used vehicles have strict loan repayment rules and require the loan to be fulfilled within a specific duration which is dependent on the original invoice date, while personal loans will have different terms which are often more flexible.

You will not be required to pledge any collateral as security against the personal loan.

Tips on Buying a Used Car or Vehicle on EMI

Get the vehicle and its papers inspected thoroughly to ensure it is in top condition.

Don't forget to transfer the vehicle’s Registration Certificate (RC) in your name.

Calculate the actual cost of ownership which includes the cost of the used car or vehicle, the running costs, paperwork charges as well as repairs and maintenance charges.

Make sure you have your insurance and related paperwork in place and protect yourself from unforeseen costs such as auto loan processing fees.