Instant ₹3 Lakh Personal Loan Online

In today’s world, it’s not uncommon to need a little extra money from time to time. Whether it’s for an unexpected car repair or a last-minute plane ticket, sometimes we just need a little help. That’s where Freo Instant ₹3 Lakh personal loan comes in.

For those times when you need instant financial help, an online personal loan can be a great solution. But how do you know if you need a ₹3 Lakh Personal Loan? Let’s take a look at these 8 reasons why you might need one.

Debt Consolidation

If you have multiple debts with high interest rates, consolidating those debts into one personal loan can save you money on interest and help you get out of debt faster.

Education

Whether you're looking to go back to school or pay for your child's education, you can take an education loan in most cases. But what about the miscellaneous costs? You can get a personal loan of ₹3 Lakh for education to cover these costs.

Business

What if you have a great business opportunity but don't have the cash on hand to take advantage of it? A ₹3 Lakh personal loan can act as a business loan and help you cover the costs and avoid going into debt.

Paying a Down Payment for Another Loan

Whether you are buying a car or a house, the down payment can be a big obstacle. If you have the cash but don't want to deplete your savings, a ₹3 Lakh loan can be a great solution.

Wedding Expenses

Exotic Vacation

Home Renovation

Medical Expenses

These are just a few of the reasons why you might need a ₹3 Lakh Personal Loan. If you find yourself in a situation where you need quick cash, a personal loan can be a great solution.

Features and Benefits of Instant ₹3 Lakh Loan From Freo

Get Instant Approval

Instant online loan approval within 4 minutes.

Customized Borrowing

Facility to borrow as little as ₹3,000 from the approved credit limit.

Affordable Interest Rate

Interest rates start from 1.08% per month.

Works as a Credit Card

Complimentary Freo Credit Card* for online & offline purchases. (*Valid only for RBL-approved customers).

Flexible Repayments

Freedom to choose the repayment schedule - Anywhere between 2-36 months.

Online Easy Transactions

Manage your transactions and account remotely via the easy-to-use mobile app.

Process to Apply for Freo ₹3 Lakh Personal Loan

It is very easy to apply for a personal loan of ₹10,000 from Freo. You can apply for a loan either on our website or by downloading the Freo app.

Eligibility Criteria

Profession – Salaried or Self-Employed

Age – Above 21 years and below 60 years

Minimum Monthly Income – ₹ 20,000

Work Experience – 3 years and above

Credit Score – 650 and above

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

Interest Charged by Freo for a ₹3 Lakh Personal Loan

If you’re looking for a personal loan, the interest rate is probably the most important factor for you. Luckily, Freo has some of the most competitive interest rates on the market. Depending on your credit score and repayment ability, you could get an interest rate as low as 13% per year.

Someone like you is happy with Freo

With Freo's Personal Loan, you will have money available instantly 24x7 to use anytime, anywhere. Click below to experience its power.

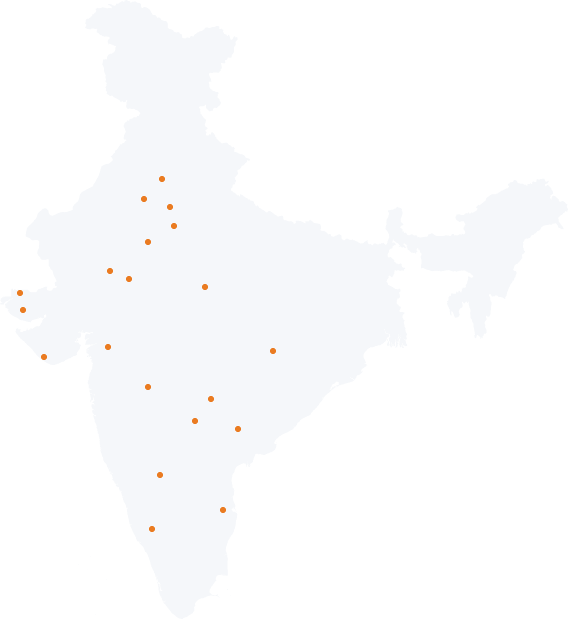

Our journey so far

Different Ways to Use Freo Personal Loan 2.0