Personal Loan for Government Employees

Being a government employee gives you job security, but might not allow for a financial bandwidth to deal with emergencies. Freo (Formally MoneyTap) personal loan for government employees can resolve your sudden financial woes.

Unexpected Emergency Situations Where Freo Personal Loan Can Help

Being a salaried person, every rupee you earn is budgeted for, which leaves you with little or no liquid cash to take care of an emergency that can strike anytime. That’s why you should consider applying for personal loans for government employees that allow you to borrow money as per your needs without collateral.

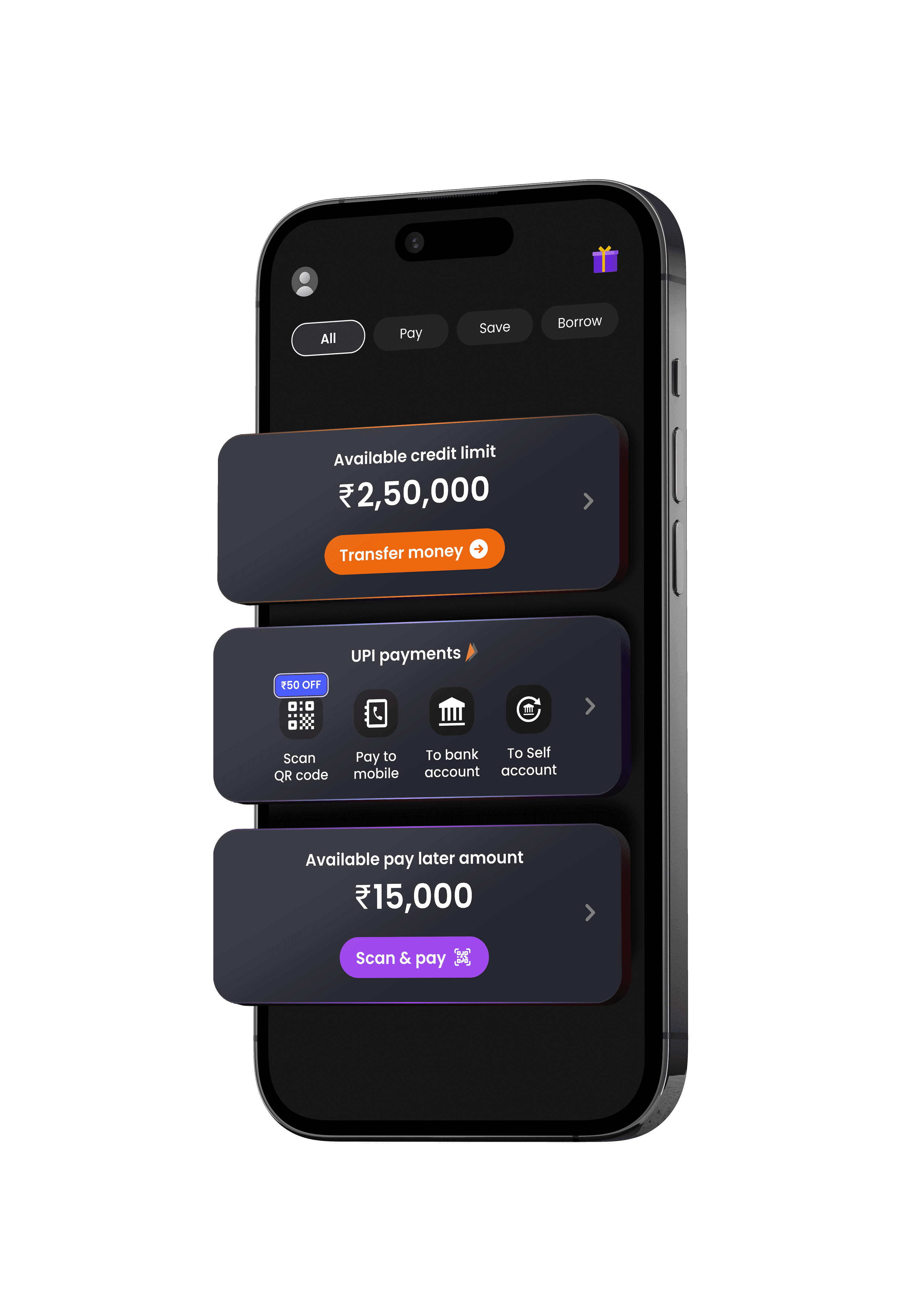

Why Freo?

Super Fast

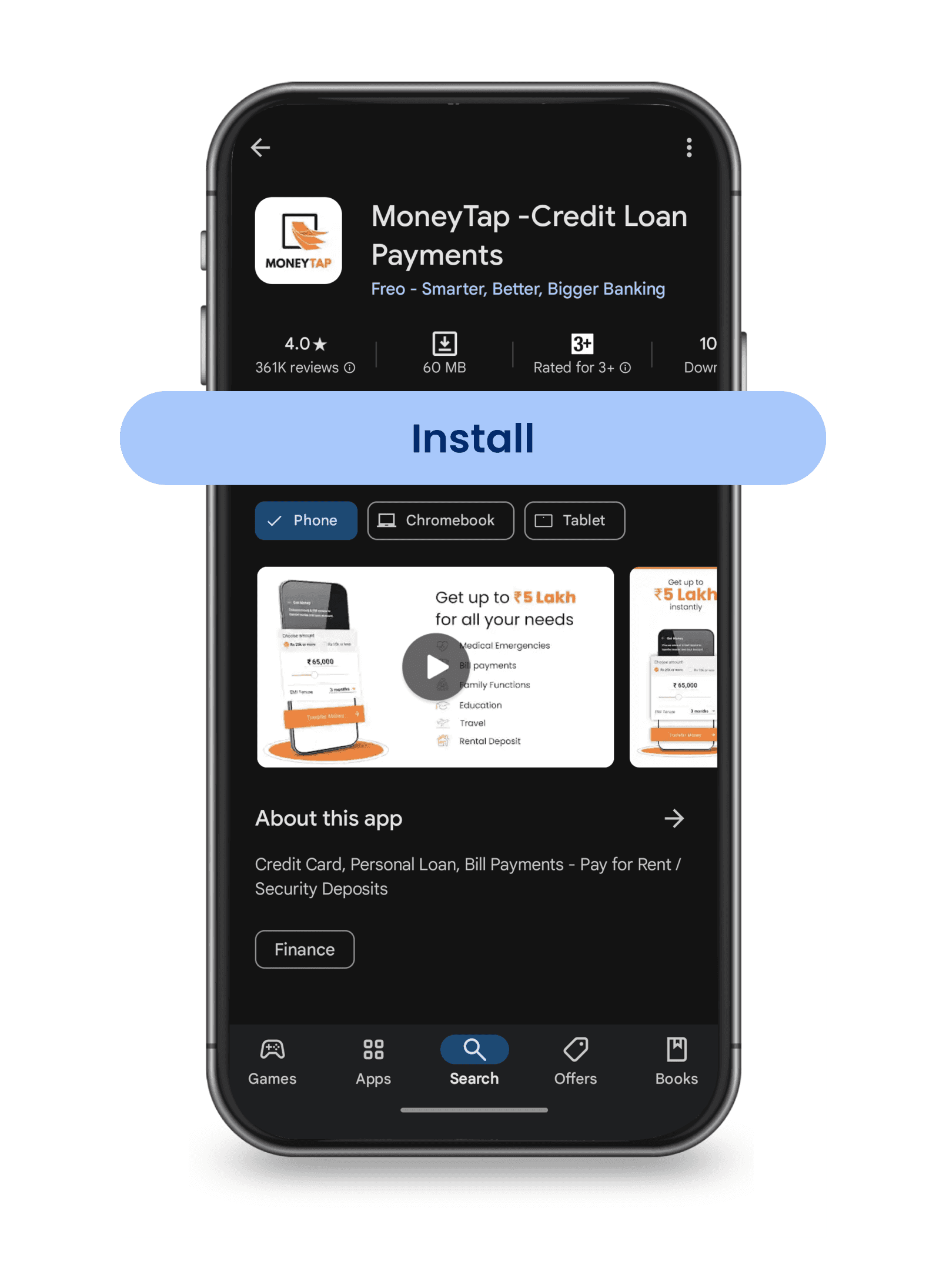

Would you believe if we say that the pre-approval is almost instantaneous? Well, it’s true. All you need to do is download the app and register. You will get instant pre-approval on the app without having to wait or call anyone.

Zero Usage, Zero Interest

This feature makes it one of the most affordable loans in Vadodara. Unlike other loans where you have to pay interest on the entire limit from day 1, with Freo you only pay for the amount you withdraw, whenever you withdraw it. If you don’t use it, you don’t pay any interest rate on it.

Twice as Good

Is it an instant cash loan? Is it a credit card? Well, it’s both! Freo allows you to use the line of credit the way you want, at no extra cost.

No Vulnerability

You can rest assured that your personal data and money is safe with Freo. We use the best encryption systems available to ensure that none of your information is vulnerable at any stage. Freo is offered in partnership with leading banks in India.

‘Immortal’ Loan

This basically means that once the line of credit is approved, you don't need to re-apply the next time you want a quick cash loan in Vadodara. You can keep the credit line for as long as you wish, even after repayment. At no extra cost.

Eligibility Criteria

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

or

Must be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)

Must be above 23 years and below 55 years of age

Must be a resident of one of the following cities:

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

How to Apply for Personal Loan

Here are some unexpected situations you could use freo personal loan for government employees:

Bill payments

At the beginning of the month, everything looks rosy as you have your salary in your account. But as the days pass by, the funds deplete due to household expenses. And that’s when it strikes you that you are yet to make quite a few bill payments – mobile, DTH, EMIs, credit card, electricity, etc. These services have different due dates and the bills are generated depending on when the billing cycle is complete. Unfortunately, the due dates for these payments usually fall somewhere in the mid or towards the end of the month. By then, you would have already exhausted the funds and are left with no money to make these crucial payments. That’s where government personal loans can help.

Unexpected house repairs

A sudden leak in the roof, a crack in the wall, urgent need of furniture refurbishing – all of these household emergencies need urgent attention. Unfortunately, unexpected repairs are a fact of life and you’ll need a plan for how you’re going to pay for them without emptying your bank account. Home improvement loan is the answer.

Unexpected medical emergencies

Life is unpredictable and medical emergencies are unpleasant. However, a personal loan can help you meet your financial needs when you or your loved one needs emergency medical treatment.

Child’s unexpected educational

When you get your salary, you start budgeting and things go according to plan till you receive a note from school saying that you need to send your child for an educational tour to a place which is out of your budget. You are in a dilemma as every penny you have in your account is accounted for. A personal loan for government employees can help you generate the funds you need to pay for your child’s educational tour without distorting your household budget plan.

Other important or unavoidable situations:

The other occasions for which you might need a personal loan are as follows:

Purchase of phone

/ gadget /laptop

Career development

courses

Family wedding

Holiday

Child education