Best UPI Apps in India 2025

Over the last five years, the volume of digital payments in India has elevated exponentially. This is primarily because of the adoption of Unified Payments Interface (UPI) technology developed by the National Payments Corporation of India (NPCI). UPI is an instant payment system where you can transfer funds from one bank to the other in a few seconds. Presently in August 2024, UPI has registered around 14.96 billion transactions, which roughly translates to Rs 20,60,735.57 crore. A sizable chunk of share originates from Third Party Application Providers (TPAPs). In the financial sector, many made-in-India applications are connected to banking applications for a better user experience.

The first app that enabled UPI payments in India between the bank accounts was BHIM. Six years later many strong players have entered into the market by offering new and innovative services. In this comprehensive blog post, we are going to share with you the best UPI apps in India that will meet your needs.

Sr. No.

TPAP

PSP Banks

Handle Name

1

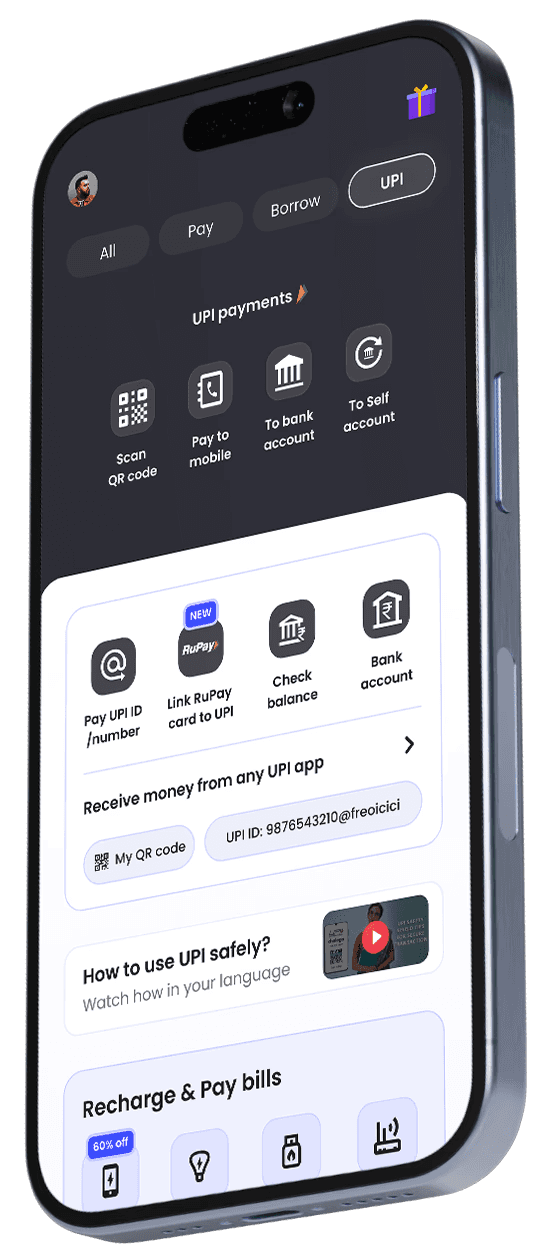

FREO

ICICI Bank

@freoicici

2

Google Pay

HDFC Bank

ICICI

@okhdfcbank

@okicici

3

PhonePe

Yes Bank

ICICI Bank

Axis Bank

@ybl

@ibl

@axl

4

Paytm

Yes Bank

Axis Bank

HDFC Bank

SBI

@paytm

@ptyes

@ptaxis

@pthdfc

@ptsbi

5

CRED

Axis Bank

@axisb

6

Amazon Pay

Axis Bank

Yes Bank

RBL Bank

@apl

@yapl

@rapl

7

MobiKwik

HDFC Bank

@ikwik

Top 10 Best UPI Apps in India 2025

1

FREO, formerly known as MoneyTap, is a digital banking platform and app in India that offers financial services to millennials and others. Freo's services include:

Savings accounts: Earn up to 7% interest

Loans: Borrow money for personal loans, flexible EMIs, and instant loans

Credit cards: Offers credit and EMI cards

Other services: UPI, Check bank balances, manage multiple accounts, pay bills, and more

Freo was founded in 2015 by Bala Parthasarathy, Kunal Verma, and Anuj Kacker. It started as an app-based personal loan in 2016 and has since evolved into a new bank. Freo has over 2 million users in more than 1,200 cities and doesn't have any physical branches.

2

Google Pay is a digital wallet developed by Google that allows the user to pay online using their mobile devices. Users can make payments via watches, tablets, Android and iOS devices.

Sending & Receiving Payments - Through Google Pay, you can easily send and receive the payment to friends and even split the bill.

Gift Cards & Cashbacks - Every transaction provides you with a scratch card that has a cashback voucher or discount coupon for a particular product/brand.

Bill Payments - Pay all your utility bills through one tap on Google Pay. You can also set up a reminder for the next payment due date.

Bank Balance Inquiry - Check your bank balance within a few seconds.

3

Another popular digital payment application is PhonePe, which provides UPI-based money transfers, bill payments and recharges. This application provides a seamless interface and tons of features to the users.

UPI-Lite - Through UPI-Lite, you can pay for transactions under Rs.200 without requiring a PIN.

Insurance - The application provides an insurance plan to save you from unforeseen circumstances.

Investment - You can now invest in mutual funds and grow money by using PhonePe.

Lending - PhonePe provides you with lending services without visiting the bank. It's completely digital, transparent, and no sales call (that’s a relief) isn’t it?

4

The Bharat Interface for Money app was launched in 2016 by the National Payments Corporation India (NPCI). This government-backed application provides plenty of features to individuals.

Offline Payment: Now, you can make offline payments without requiring an internet connection.

Languages: Currently, the application is available in 20 languages.

IPO Allotment: you can apply for IPO by using your BHIM UPI ID

Auto-Payment: You can now set auto-payment reminders for your recurring bills and mobile recharge.

5

Paytm is a well-known app in India. Apart from money transfer, the app provides you ample features, shops locally, and even applies Paytm cards for payment.

Multiple Payment Options - Paytm UPI supports various payment options like scanning, QR code, UPI ID, mobile number, and more.

Bill Payments & Online Purchase - You can pay all your bills and make online purchases, book flights, trains, and more.

Bank Account Linkage - you can link various bank accounts to a single UPI ID.

Transaction History - This provides you with an instant payment history of your transactions.

6

Cred is a reward-backed platform where users can manage and pay their credit card bills and maintain their credit card scores.

Credit Card Payment Journey - Through Cred, you can track down all the expenses, set due date reminders, and gauge the card usage statistics.

Send Money - You can send money to anyone at any time through CRED and avail points for it.

CRED Store - It’s a store for exclusive members where they can shop from their favourite brands and products at a discounted rate.

7

Amazon Pay allows you to pay for all the purchases made via your Amazon account. Additionally, it works seamlessly with other stores too thereby making it another excellent addition for UPI applications.

Amazon Pay Later - Amazon recently launched a feature where eligible customers can purchase a range of products and pay in the succeeding month or even opt for EMI.

Book Train Tickets - By partnering with the Indian Railway Catering and Tourism Corporation (IRCTC), customers can reserve tickets.

Insurance Policy - Amazon Pay also provides insurance coverage to two and four wheelers. Zero paperwork and hassle-free process, making it beneficial for the customers.

Smart Stores - This feature enables you to scan through a QR code that will present you with the available products within the range.

8

We know that so many of you remember Freecharge starting as a mobile recharge application. But with time, it turned into a fully-fledged UPI application where you can transfer money and pay bills.

Transfer Money - With one tap, you can send and receive the money. You can also receive certain cashback offers.

Security - Freecharge is backed by Axis Bank, which makes it a reliable and secure UPI payment.

Buy Now Pay Later - you can purchase products, pay later and avail benefits or cashback.

9

MobiKwik is a digital wallet that provides a variety of facilities and features like recharges, bill payments, and more.

Online Shopping - You can shop from leading merchants and brands through MobiKwik.

Cash Deposit and Cash Pickups - You can visit a nearby centre and deposit cash by generating an order from your wallet. Cash Pickup facility is available in selected cities like Delhi/ NCR, Mumbai, and Jaipur.

Offers - Every transaction through MobiKwik will provide you with an exciting offer or cashback. From booking tickets to referring someone - you can enjoy cashback and discounts.

10

PayZapp is more than a digital wallet. It’s a financial management solution that’s been led by HDFC.

Wide Range of Payments - Through PayZapp, you can pay your electricity bills, gas bills, recharges, DTH, and so much more.

OTP-Less Payments - Linking HDFC Debit/Credit card will make payments in one swipe. No longer need to wait for the OTPs.

Passbook - PayZapp provides you with a passbook feature where you can check out all the transaction history.

Final Thoughts

It can be challenging to pick UPI apps available in India, but making the correct decision can improve your digital payment experience. The above blog sums up the top contenders that provide a diverse set of features. Depending upon your specific requirements, you can opt for the app that provides enhanced features.

FAQ

Can I use the same UPI for multiple apps?

How many UPI apps can be linked to a bank account?

How many payments can be made through UPI?

Can I use UPI on multiple devices?

Can I use the same UPI for multiple apps?

How many UPI apps can be linked to a bank account?

How many payments can be made through UPI?

Can I use UPI on multiple devices?

Make your payments smoother, and safer with Freo UPI. The more you UPI, the more you unlock!

Make the Move

What are you waiting for?

MWYN Tech Private Limited

CIN: U72200KA2015PTC083534

Address: G-405,4th Floor - Gamma Block, Sigma Soft Tech Park Varthur, Kodi Whitefield Post, Bangalore - 560066

Copyright © 2025 MWYN Tech Pvt Ltd. All rights reserved.

Make the Move

What are you waiting for?

MWYN Tech Private Limited

CIN: U72200KA2015PTC083534

Address: G-405,4th Floor - Gamma Block, Sigma Soft Tech Park Varthur, Kodi Whitefield Post, Bangalore - 560066

Copyright © 2025 MWYN Tech Pvt Ltd. All rights reserved.

Make the Move

What are you waiting for?

Our Products

Quick Links

Calculators

MWYN Tech Private Limited

CIN: U72200KA2015PTC083534

Address: G-405,4th Floor - Gamma Block, Sigma Soft Tech Park Varthur, Kodi Whitefield Post, Bangalore - 560066

Copyright © 2025 MWYN Tech Pvt Ltd. All rights reserved.