Table of Content

1

How Do Savings Accounts Work?

2

Documents Required to Open a New Savings Account

3

What are the Eligibility Criteria for Opening a Savings Bank Account?

4

How to Open a Savings Bank Account Online?

5

How to Open a Savings Account in Your Nearest Bank Branch?

6

What Features to Look for in a Savings Bank Account?

How to Open a Savings Bank Account Online?

Step 1: Choose a Bank

If you have not already selected a bank you want to trust your money with, this is your time to get started. Today, banks offer all different types of savings accounts to provide you interest on your savings. Some private sector banks offer higher interest rates than the standard 4%. Similarly, a high-yielding savings account will offer higher interest rates than average so do proper research and compare the options you have.

Step 2: Keep Required Documents Handy

After selecting the bank, make sure to keep all the required documents mentioned above handy.

Step 3: Fill Out the Online Application

Go to the bank’s official website and fill out the online application with your personal information. Ensure you are doing this step under a secured network connection to reduce your chances of a cyber breach. The personal data required would be:

Name

Date of birth

Address

Contact information

Information from your required documents

Step 4: Get Started by Funding Your Account

Once you open your savings account online, you are required to deposit a certain amount of money to activate your account. You can transfer the fund from your existing account or can fund with a cheque.

How to Open a Savings Account in Your Nearest Bank Branch?

If you are too paranoid to trust the internet and open a savings account online, you can still visit the nearest bank branch, if your bank has one. Here’s what you will need to do:

Step 1

Don’t skip the research! It’s vital to research since many banks offer different types of savings accounts and provide exclusive benefits. So, search for a savings account that aligns with your goals and vision.

Step 2

Once you have chosen the one, visit their branch along with the necessary documents like original copies of identity and address proof for verification and passport size photographs.

Step 3

You will be given an application form that needs to be filled out and submitted with the documents.

Step 4

Then the bank will verify everything and open a savings account within the specified time.

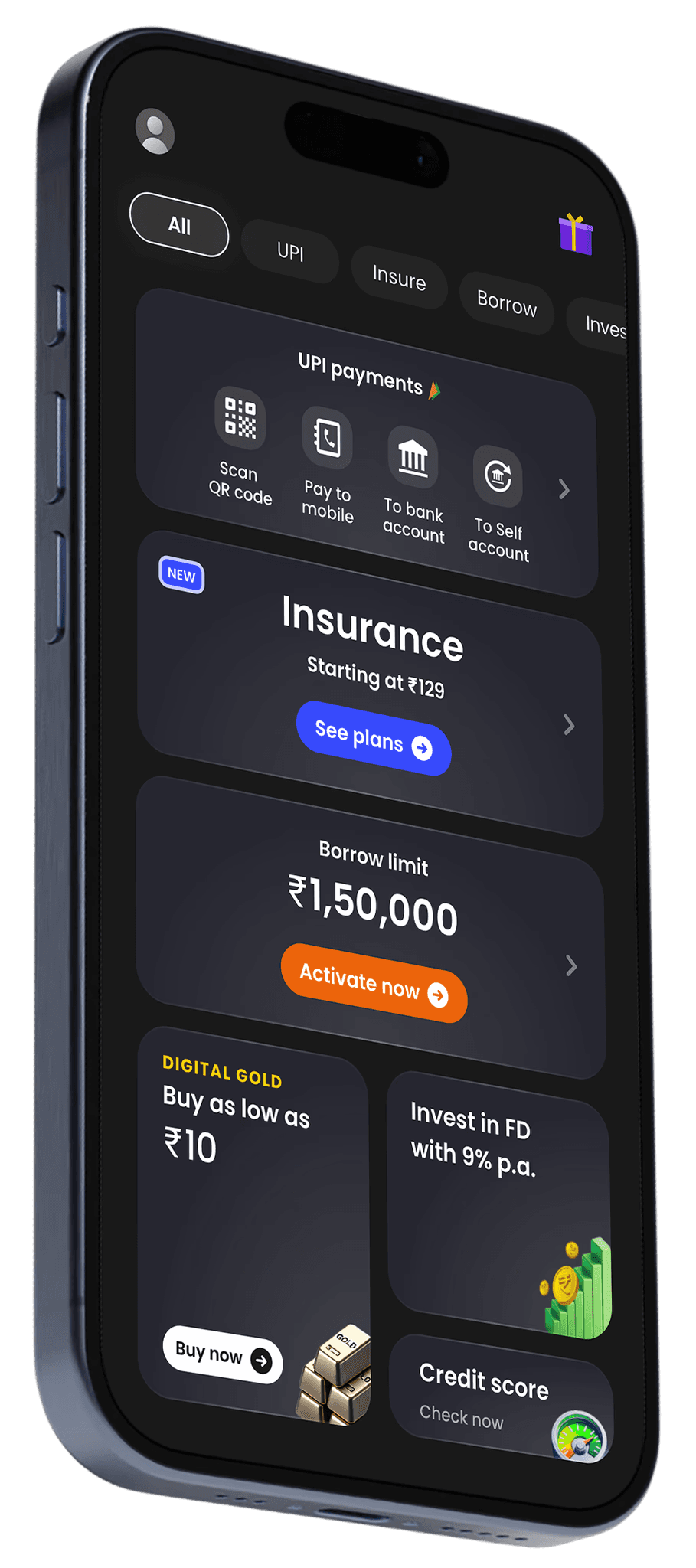

Get Started with Smart Investments Today!

Investing has never been easier! With Freo, you can explore a world of opportunities, from instant 24k Digital Gold purchases to high-return Fixed Deposits. Secure your future, grow your wealth, and make every rupee count. Start your journey to smarter financial choices with Freo now!