Personal Loan for Women

The ever-evolving women’s role has brought about a massive and positive impact on the economy. Today’s women are more in control of their finances than they ever were. Access to credit has opened up many economic opportunities for women. Women with their own wish list and perspective take charge of their spending & can afford expenses such as wedding loans, credit card loans, personal loans, etc.

A survey revealed that the average loan amount women borrow is 35% higher than that of men.

As of December 2019, women occupied 29% of home loans in India.

Women are taking measures to do well financially and contribute to daily household expenses. A recent study reveals that women expenditure is at about 88% out of the total spending.

Nearly 46% of the service class women are taking loans compared to the self-made businesswomen.

Why Personal Loan Is a Go-to Option for Most Millennial Women?

Unsecured loans, approved without collateral

You do not have to liquidate your investments

Get funds on the go

Competitive interest rates

Quick and easy approval

Flexibility in repayment

Eligibility Criteria

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

or

Must be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)

Must be above 23 years and below 55 years of age

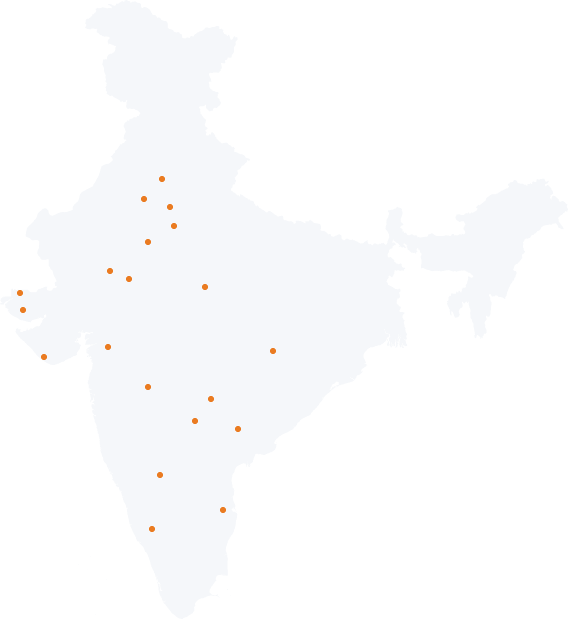

Must be a resident of one of the following cities:

Required Documents

Pan Card Number

Professional Selfie

To be taken on the Freo App

Address Proof

Valid Driving License / Valid Passport / Aadhar Card

ID Proof

Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card

How to Apply for Personal Loan

Other Loans for Women

Home Loans

Owning a house is probably one of the biggest dreams for many women, and home loan for women makes it possible to make their dream a reality.

A maximum of 90% of the property’s value can be availed as home loan, and the rest of the amount is to be paid by the borrower as a down payment. Many banks in India offer a concessional rate of interest on home loans for women. There is a difference of around 0.05% on the interest rate between loan applications made by men and women. Home loan interest rate for women borrowers starts at 6.95%.

Personal Loan for Women

A personal loan is an unsecured loan which can be borrowed for any purpose. Personal loans for women come handy when they are looking to get married or falling short of money in any circumstances. They can use a personal loan for travel, shopping, or even to begin their entrepreneurial journey. To get a personal loan, women need to have a good credit score and a steady source of income. Lowest personal loan interest rate is 10.45%.

Gold Loan for Women

Gold is popular in India as women widely invest in gold ornaments. However, unlike other types of loans, gold loans doesn’t need income proof or a good credit score. Women with little or no income, but are in possession of gold can get a gold loan. Gold loan is best for urgent requirement of money. Lowest interest rate on a gold loan is 9.90%. However, in case of failure to repay the loan, the gold which is pledged as collateral can be seized by the bank to recover the loan amount.

Government loan for women

The government has introduced various schemes to promote financial freedom of women. Some of the schemes launched by the government are:

Stand Up India: This scheme allows women entrepreneurs to apply for bank loans between ₹ 10 Lakh and ₹ 1 Crore in the manufacturing and trading sector for the first time.

Mudra Yojana Scheme: This scheme grants business loans for women, ranging between ₹ 50,000 to ₹ 10 Lakh for women. Women who aspire to become entrepreneurs can easily get this loan to start small new enterprises and businesses.

Stree Shakti Package: This scheme offered by State Bank of Mysore provides a collateral-free loan of up to ₹ 5 Lakh at a rate of interest much lower than the base rate of the bank. However, to get this loan, women have to hold 51% or more stake in the business.

Synd Mahila Shakti: This scheme offered by Syndicate Bank is for new or existing women entrepreneurs. They can get a short term or term loan for up to 10 years. However, women need to have at least a 50% stake in the financial holding of the business.

Cent Kalyani: The scheme offered by Central Bank of India is for women in rural, cottage industry, retailing, MSMEs, entrepreneurs for various purposes. The maximum limit of the loan under this scheme is ₹ 1 Crore without collateral.

Orient Mahila Vikas Yojana Scheme: Initiated by the Oriental Bank of Commerce, this scheme provides collateral-free business loan for women of up to ₹ 25 Lakh. The maximum tenure of the loan is 7 years, and there is 2% concession on the rate of interest.

Women in India have come a long way. With women’s financial stability gaining importance, women are offered a host of financial benefits to be financially independent and lead their lives without having to worry about money. These loans for women encourage women to invest in property, look after their wellbeing, borrow funds for any financial need or make their entrepreneur dream come true.

freo personal loan for women is designed to give wind beneath your wings. freo offers personal loans for women of up to ₹ 5 Lakh to fulfil your dreams and take care of your financial requirement in a hassle-free and convenient manner.

Someone like you is happy with Freo